Using the FAA B4UFLY drone app.

First off, if you are not using the FAA B4UFLY drone app (https://www.faa.gov/uas/b4ufly/) on your smart phone or tablet, go download it. I understand that the app is not definitive answer to where you can fly, but it is a nice way to get a quick reference.

A friend of ours asked if we could take aerial video of a small gathering of people she is organizing. Since we do not have our 333 Exemption yet (should be soon…), we can’t do anything for hire but thought it would be a great way to get more experience.

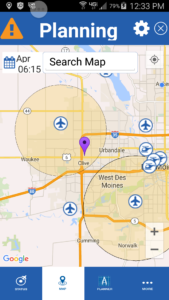

In our case I entered the address of the field our friend wanted the video taken and let the system pick out the location and overlaid the nearest airports. In this case we were outside the five-mile radius for a commercial airport but inside the five miles for a small private field, although, that small field doesn’t exist anymore. So the data might be a bit behind, but at least it reminded us where we should be concerned.

FYI, I looked at a couple other airports that I knew were gone and they were still on the map, so it is important to know your area. Don’t rely just on this application.

The next step was to get permission from the facility owner and potentially the city. I called the city and they informed me that they are relatively unprepared for drone activity, but they have attended a few conventions and training programs where drones have been discussed. At this time the city has a few model aircraft rules in place which will cover the operation of drones for the time being. Those rules do not allow models on public city land or parks.

But since we were flying on private ground we would need to talk to the owners. Will let you know how the whole thing goes, weather permitting.

Take a look at the screen short for the B4UFLY app. The purple pin is where the address put us compared the two airports. Kind of cool